72. LSTM Prediction of Stock Prices#

72.1. Introduction#

Stock trading trend prediction is one of the tasks involved in quantitative trading, that is, to analyze and predict price trends through statistical and machine learning methods. Generally, we can use time series related modeling methods, but in this challenge, we will try to use LSTM to complete stock prediction analysis.

72.2. Key Points#

LSTM Network Construction

Stock Price Prediction

I believe every stock investor hopes to predict stock prices and profit from the stock market with the ability to foretell the future. Since there are many factors affecting stock price changes and most of these factors are not quantifiable, this is an extremely difficult task.

However, if we regard the historical stock data as a time series, we can analyze the trend changes through time series modeling in statistics. In addition, the recurrent neural network also performs well for sequence models. Therefore, in this challenge, we will use the LSTM network to predict the stock price trend.

First, we obtain the trading data of real-time stocks. Here, we choose the Quandl financial data module. For this challenge, it is necessary to install the Python library provided by Quandl first.

{note}

pip install quandl

Unregistered users of Quandl can submit 50 access requests per day, while there is no limit for registered accounts. For this experiment, we use the test account provided by the course. If you use it by yourself, please obtain the API KEY by registering for free through the official website.

import quandl

# 该 API KEY 仅限课程使用,其他用途请自行注册

quandl.ApiConfig.api_key = 'DdXEs2xFciyUXrER9-a7'

# 获取苹果公司股票数据

df_aapl = quandl.get('WIKI/AAPL')

df_aapl.head()

| Open | High | Low | Close | Volume | Ex-Dividend | Split Ratio | Adj. Open | Adj. High | Adj. Low | Adj. Close | Adj. Volume | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||

| 1980-12-12 | 28.75 | 28.87 | 28.75 | 28.75 | 2093900.0 | 0.0 | 1.0 | 0.422706 | 0.424470 | 0.422706 | 0.422706 | 117258400.0 |

| 1980-12-15 | 27.38 | 27.38 | 27.25 | 27.25 | 785200.0 | 0.0 | 1.0 | 0.402563 | 0.402563 | 0.400652 | 0.400652 | 43971200.0 |

| 1980-12-16 | 25.37 | 25.37 | 25.25 | 25.25 | 472000.0 | 0.0 | 1.0 | 0.373010 | 0.373010 | 0.371246 | 0.371246 | 26432000.0 |

| 1980-12-17 | 25.87 | 26.00 | 25.87 | 25.87 | 385900.0 | 0.0 | 1.0 | 0.380362 | 0.382273 | 0.380362 | 0.380362 | 21610400.0 |

| 1980-12-18 | 26.63 | 26.75 | 26.63 | 26.63 | 327900.0 | 0.0 | 1.0 | 0.391536 | 0.393300 | 0.391536 | 0.391536 | 18362400.0 |

df_aapl.tail()

| Open | High | Low | Close | Volume | Ex-Dividend | Split Ratio | Adj. Open | Adj. High | Adj. Low | Adj. Close | Adj. Volume | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date | ||||||||||||

| 2018-03-21 | 175.04 | 175.09 | 171.26 | 171.270 | 35247358.0 | 0.0 | 1.0 | 175.04 | 175.09 | 171.26 | 171.270 | 35247358.0 |

| 2018-03-22 | 170.00 | 172.68 | 168.60 | 168.845 | 41051076.0 | 0.0 | 1.0 | 170.00 | 172.68 | 168.60 | 168.845 | 41051076.0 |

| 2018-03-23 | 168.39 | 169.92 | 164.94 | 164.940 | 40248954.0 | 0.0 | 1.0 | 168.39 | 169.92 | 164.94 | 164.940 | 40248954.0 |

| 2018-03-26 | 168.07 | 173.10 | 166.44 | 172.770 | 36272617.0 | 0.0 | 1.0 | 168.07 | 173.10 | 166.44 | 172.770 | 36272617.0 |

| 2018-03-27 | 173.68 | 175.15 | 166.92 | 168.340 | 38962839.0 | 0.0 | 1.0 | 173.68 | 175.15 | 166.92 | 168.340 | 38962839.0 |

Through the above code, we can load the historical trading data of Apple since its listing. Since real-time data requires a paid subscription, we can only obtain free data with an earlier cut-off date.

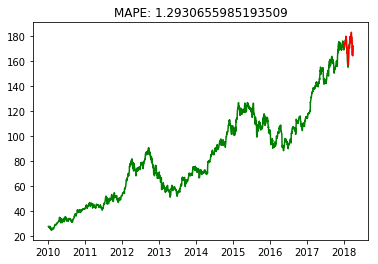

For this challenge, we only use the historical data of Apple

after 2010 and specify the adjusted closing price (Adj.

Close) as the prediction target. Next, we first plot the change

curve of the closing price.

from matplotlib import pyplot as plt

from pandas.plotting import register_matplotlib_converters

%matplotlib inline

register_matplotlib_converters()

df = df_aapl['2010':]["Adj. Close"]

plt.plot(df)

Then, for this challenge, the data before 2018 is used as training data, and the data after 2018 is used as test data. At the same time, we normalize the data.

import numpy as np

from sklearn.preprocessing import MinMaxScaler

df_train = df[:'2018'] # 训练数据

df_test = df['2018':] # 测试数据

scaler = MinMaxScaler(feature_range=(0, 1)) # 归一化

df_train_scaler = scaler.fit_transform(df_train.values.reshape(-1, 1))

df_test_scaler = scaler.transform(df_test.values.reshape(-1, 1))

df_train_scaler.shape, df_test_scaler.shape

((2070, 1), (59, 1))

Since

MinMaxScaler

must be passed a two-dimensional array,

.reshape(-1,

1)

is used above to transform the shape of the data.

Next, we need to design an experimental plan. Here, we adopt the strategy of predicting tomorrow based on today, with a time interval of 1 day. Therefore, the time series needs to be shifted by 1 day for correspondence.

time_step = 1

train_t0 = df_train_scaler[:-time_step] # 训练数据错位 1 天

train_t1 = df_train_scaler[time_step:]

test_t0 = df_test_scaler[:-time_step]

test_t1 = df_test_scaler[time_step:]

As shown above, when the

t0

sequence and the

t1

sequence are corresponding, there is a 1-day time shift.

Therefore, we can use

train_t0

as the input to the network, while

train_t1

is used as the target value to train the LSTM network.

Exercise 72.1

Challenge: Build an LSTM model using the TensorFlow Keras sequential model building method.

Requirement: Define the model structure with reference to the expected output.

import tensorflow as tf

## 代码开始 ### (≈ 4 行代码)

model = None

## 代码结束 ###

Solution to Exercise 72.1

import tensorflow as tf

### Code starts ### (≈ 4 lines of code)

model = tf.keras.Sequential()

model.add(tf.keras.layers.LSTM(32, input_shape=(1, 1), return_sequences=True))

model.add(tf.keras.layers.LSTM(16))

model.add(tf.keras.layers.Dense(1))

### Code ends ###

Run the test

model.summary()

Expected output:

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

lstm_1 (LSTM) (None, 1, 32) 4352

_________________________________________________________________

lstm_2 (LSTM) (None, 16) 3136

_________________________________________________________________

dense_1 (Dense) (None, 1) 17

=================================================================

Total params: 7,505

Trainable params: 7,505

Non-trainable params: 0

_________________________________________________________________

Next, compile and train the model.

Exercise 72.2

Challenge: Compile and train the LSTM model defined above.

Requirement: Freely choose the parameters.

## 代码开始 ### (≈ 2 行代码)

## 代码结束 ###

Solution to Exercise 72.2

### Code starts ### (≈ 2 lines of code)

model.compile(loss='mse', optimizer='adam')

model.fit(np.atleast_3d(train_t0),

train_t1.reshape(-1), epochs=5, batch_size=32)

### Code ends ###

Finally, use

test_t0

for testing and calculate the MAPE value between it and

test_t1. At the same time, the challenge requires plotting the

real data change curve and the predicted structure change

curve on the same graph for comparison. Since the data used

for prediction is the normalized result, you can use the

inverse_transform

method provided by MinMaxScaler to restore the data.

Exercise 72.3

Challenge: Test and plot a comparison image of the real and predicted results.

Requirement: Show the real results as green lines and the predicted results as red lines, referring to the expected output style.

## 代码开始 ### (> 10 行代码)

## 代码结束 ###

Solution to Exercise 72.3

test_pred = model.predict(np.atleast_3d(test_t0)) # Predict the test data

test_pred = scaler.inverse_transform(test_pred) # Restore the data

# Replace the prediction part in the original data format and set the training part data as NAN for easy plotting on the same graph

df_pred = df.copy()

df_pred[len(df_pred)-len(test_pred):] = test_pred.reshape(-1)

df_pred[:-len(test_pred)] = np.nan

# Calculate the MAPE result

def mape(y_true, y_pred):

n = len(y_true)

mape = 100 * np.sum(np.abs((y_true-y_pred)/y_true)) / n

return mape

y_true = df[len(df_pred)-len(test_pred):].values

y_pred = test_pred.reshape(-1)

mape = mape(y_true, y_pred)

plt.plot(df, 'g')

plt.plot(df_pred, 'r')

plt.title(f"MAPE: {mape}")

Expected output: